Are You Prepared to Live to 100?

Jan 24, 2019

When Living to 100 is Not Uncommon

As Yogi Berra once said, “It’s tough to make predictions, especially about the future.” However, it’s not too challenging to see that many of us will be living longer, often much longer, than previous generations. Remarkably, researchers predict than the first person to live to 150 is alive today. Event Yogi is example of increasingly longevity: he lived to 90 years of age.

We’re on the brink of where living to 100 will not be uncommon. In fact, demographers predict that a child born in the developed world today has a greater than 50% chance of living to be over 100. It’s not just about young people, however. If you’re 65 and healthy, odds are you will live to at least 90 years.

How Do You Plan to Live to 100? Start with Realistic Expectations

How do you plan to live to 100? Carefully (but be flexible!).

We need to be honest with our particular circumstances and range of possible outcomes. For those nearing traditional retirement age, be realistic about how long you may live and focus on lifestyles that work financially and make you happy overall. For those in mid-life, there will most likely be changes in your job or career and related fluctuations in income. At the same time, it’s good to make an effort to stay in touch with friends while also reaching out to new ones. For those earlier in life, gain an appreciation for the change that will occur over your lifetime and be open to navigating these changes successfully.

In every case, we’re all trailblazers for a new era.

Lynda Gratton and Andrew Scott recently tackled this subject in their award winning book The 100-Year Life: Living and Working in the Age of Longevity. With Ms. Gratton’s background as a psychologist and Mr. Scott’s as an economist, the authors – both professors at the London Business School – provide a blended perspective of how to prepare for such a long life. They conclude that how people approach life will change profoundly.

An End to the Three Stage Life

The traditional stages of life – education, employment and retirement – will end. Laura Carstensen, Director of the Stanford Center on Longevity, has long advocated for reimagining this standard life course as she describes in the video The Big Idea in Four Minutes. She posits that there is an opportunity to work less during the child rearing years and to work more later thereby pushing out the traditional retirement stage. Ms. Gratton and Mr. Scott see the same thing: life will become multi-staged and transitions will become the norm. Visionaries like Marc Freedman and his colleagues at Encore.org are helping create a stage after one’s work career but before retirement which they call the “encore career.” Encore.org encourages people to use their gifts and experience to help society at large, increasingly in an intergenerational context.

The Role of Work and Financial Planning

The nature of work will change. With technology disruption around the corner, such as with artificial intelligence, machine learning and other advances, people will need to evolve to make sure that their skills fit with the needs of the workplace. Job changes are already changing at an accelerated path: LinkedIn found that Millennials have switched jobs at twice the rate of GenX.

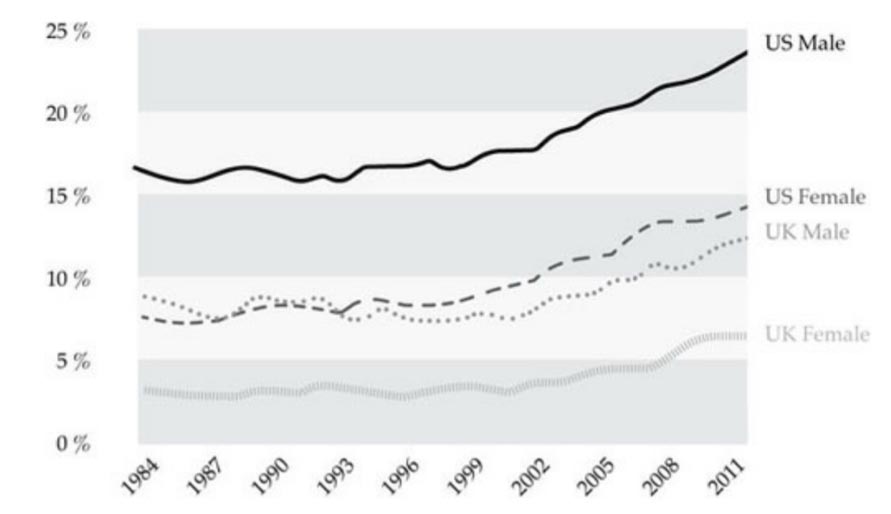

One of the likely outcomes is that more people will work beyond traditional retirement age. Signs indicate that this is already happening (see graph below). Given pressures on pensions and social security, it is unlikely that government will be able to provide the same benefits prior generations received, particularly in the context of longer lives. More of the responsibility will fall on individuals to navigate financial security in this new era. Indeed, the power of compounding returns – applied to the spread between income and expenses – becomes even more significant over the course of a long life.

Percentage of People Working for US and UK 64 years and over

Source: The 100 Year Life

Note the Impact of Compounding Returns for Many Aspects of Life

While getting finances squared away is critical, there is much more to succeed in long life planning than having a proper nest egg. A key part of the equation is having properly invested in other elements of life. Are you able to have a clear purpose at each stage of life? Do you have relationships to support you in your journey? Are you actively caring for your health? Much like compounding investment returns, good habits in these areas can ultimately have an outsized impact in your overall well-being.

Valuing the Importance of Place

The role of place – or “Power of Place” as outlined in a SmartLiving 360 blog from last year – is an important element, too. The right living situation can strengthen our social connections and reduce the risk of social isolation and loneliness. There is simply no equal to regular, face-to-face interaction with people who know and care for you; and certain neighborhoods, for example, are conducive to creating such relationships.

Further, the right housing can keep us healthy. For example, about 1/3 of older adults fall each year leading to over 700,000 hospital visits. Most of these falls occur within homes which is not surprising given that less than 5% of all housing stock is designed with features accommodating people of moderate mobility difficulties. Fortunately, new, attractive housing options designed for people of all ages are emerging.

What’s My Next Step?

Where do you go from here? For some, talking to your financial planner is a good next step to make sure the key assumptions driving your plan are conservative and account for the odds of increasing longevity. There are several free online financial tools that can assist in this, too.

But the opportunity is broader. Ms. Gratton and Mr. Scott have created a website to accompany their book: www.100yearlife.com. This website includes a diagnostic tool to help evaluate your readiness across several dimensions, including those that are tangible, such as your finances, and those that are intangible, such as the strength of your friendships. Designing Your Life, a NY Times best-selling book by a couple of Stanford professors, is also a useful guide and was the subject of a SmartLiving 360 blog (“Design Thinking for Your Life”).

I would expect more and better tools to emerge in the future to help properly plan and execute on these plans in the context of an increasingly long life.

A Mindset to Thrive, Not Just Survive

The most important step is to have a mindset to see these extra years as a gift – in the form of thousands of days as compared to prior generations – and one worth planning for and embracing. While we learn to seize this opportunity, we should also an effort to educate the next generation as this trend will impact them even more.

Take the Right Place, Right Time Assessment

Are you in the right place for right now? This quick assessment will reveal opportunities to improve your life.

Subscribe to The Blog

We hate SPAM. We will never sell your information, for any reason.